1st edition, 2018

Economic News

Liège: A Major Healthcare Hub

Liège does not stop attracting foreign biotech or medical companies in search of a favorable environment to prosper.

Liège currently has 72 life science companies that create more than a hundred new jobs a year.

Marc Foidart, deputy director of Meusinvest (public investment fund of Liège) underlined that the region hosts every two months a new biotech or medtech company. "which means from 5 to 7 companies a year over the last 5 years.

The health sciences are becoming the most important sector in Meusinvest's investments ".

Liège has indeed become a gateway to the internationalization of these companies besides it becomes attractive for other companies that develop skills in the areas of cardiology, neuroscience, inflammatory diseases ...

Brussels Boost the future economy

The economy of Brussels' city is dominated by activities within the service and public service industries.

The Brussels Capital Region accounts for nearly 9% of all exports from Belgium, and service industries add another 9%. The foremost areas of production have been electronics, chemicals, printing, publishing, clothing, telecommunications, aircraft construction, and the food industry.

Brussels is known as the Capital of the European Union and is home to many national and multinational companies. There are approximately 50,000 businesses, of which around 2200 are foreign. This number is constantly increasing and can well explain the role of Brussels in the European subcontinent.

Brussels holds more than 1,000 business conferences annually, making it the fourth most popular conference city in Europe. It is rated as the seventh most important financial center in the world. The city’s infrastructure is very favorable in terms of starting up a new business.

About 60% of foreign companies have their headquarters in Brussels which include well-known companies.

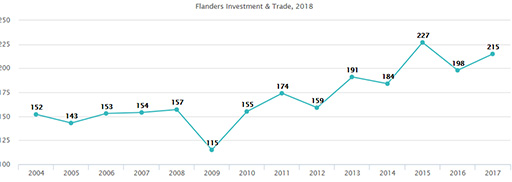

Foreign investment in Flanders on the rise

In 2017, foreign companies invested €2.08 billion in Flanders, divided over 215 projects, creating 5,377 new jobs.

€2.08 billion invested, 215 projects & 5,377 new jobs: 2017 was a strong year for foreign investment in Flanders, according to the most recent data from Flanders Investment & Trade (FIT).

The small dip in foreign direct investment (FDI) in 2016 caused by socio-economic and geopolitical circumstances turned out to be only temporary, as last year companies and investors found their way back to Flanders.

In 2017, job creation reached the highest level in 15 years.

Based on the number of investment projects and the corresponding job creation, it appears that foreign companies mainly invested in the following 3 activities: production - 71 projects (33.02%) accounted for 1,832 extra jobs (34.07%) in Flanders.

Algeria Economic Outlook

Algeria aims to amend its energy law in 2018 as it plans to improve contract terms to attract needed foreign investment, the economy seems to have recovered somewhat in the last quarter of 2017 from the third quarter’s bleak performance, thanks to the rally in energy prices and to a recovery in the underdeveloped non-oil sector.

Estimates from the Central Bank put growth at 2.2% for 2017. Nevertheless, state-owned oil company Sonatrach recently announced USD 56 billion of investment over the next five years.

The government has started consultations with foreign partners in an attempt to improve the investment climate and remove hurdles to investment.

Algeria is seeking foreign partners with expertise to develop shale gaz.

Dubai ruler enacts new laws to boost financial hub

New laws aim to improve Dubai International Financial Centre's private wealth management and succession planning platforms.

Dubai ruler Sheikh Mohammed bin Rashid Al Maktoum has enacted two new laws that aim to improve and expand Dubai International Financial Centre's (DIFC) private wealth management and succession planning platforms.

Both the Trust Law and Foundations Law are in line with the previous recommendations of the DIFC’s Wealth Management Working Group and follow extensive consultation with industry professionals and family business networks both regionally and globally.

In addition to serving families in their wealth and succession planning, the laws will be serve the financial services community in structured financing transactions in creating insolvency remote and orphan structures.

Investcorp to launch $100m fund for Omani pension funds

The Opportunities Fund will focus on private equity investments in mid-sized companies in the US and Europe.

Global investment firm Investcorp will launch a $100m fund dedicated to Oman’s pension funds, the Ministry of Defence Pension Fund announced at an event in Muscat.

The Opportunities Fund will focus on private equity investments in mid-sized companies, across a number of sectors, in the US and Europe.

Investcorp executive chairman Mohammed Alardhi said Oman is an important market for the firm due to growth potential in its economy.

SAUDI ARABIA: SASO CONFORMITY ASSESSMENT PROGRAM UPDATE 2

Relative to the implementation of the Saudi Product Safety Program ‘SALEEM* Project’, please be informed that the Saudi Standards, Metrology and Quality Organization (SASO) is putting into effect the implementation of several Technical Regulations governing specific products that are to be distributed to the Saudi market...