Newsletter November 2018

Economic News from the Arab world

ARAB WORLD

Foreign Direct Investment (FDI) results

The recently issued “FDI Report 2018” gives an overview of the foreign investment figures for 2017 in the Arab world and worldwide. The figures for the Middle East and North-Africa look promising. The number of FDI-projects increased by 25% in Oman, 15% in Bahrain, 11% in Morocco and 8% in the United Arab Emirates (UAE). The number of jobs created increased too. The UAE stays by far the main destiny for global foreign investment. Capital investment in Oman went up by an impressive 32% to 23.1 billion dollar.

ALGERIA

Boosting the economy

The Central Bank of Algeria allocated loans of more than 80 billion U.S. dollars to public and private sectors in the first half of 2018, a 6% increase compared with a year ago, according to a report issued by the bank. Loans assigned to the public sector rose by 7.6% to more than 39 billion dollars compared with a year ago, while those allocated to the private sector amounted to some 40 billion dollars, with an increase of 4.3% over the same period last year. The report said that 54.51% of the loans are long-term credits allocated to state-run companies in the hydrocarbons sector. Short-term loans accounted for 26.8%, while the share of medium-term loans stood at 18.62%.

BAHRAIN

Government implements VAT

Bahrain’s parliament has approved the introduction of 5% value-added tax (VAT) in the kingdom from January 1 2019. The bill, which would see Bahrain join the UAE and Saudi Arabia in implementing VAT, must also be approved by the parliament’s Upper House. “The introduction of VAT will be a big challenge for the local Bahrain market,” said Michael Camburn, Bahrain Indirect Tax Leader at Deloitte Middle East. “Businesses now have less than four months to be prepared for these changes”. Camburn added that “if organisations have so far not yet started, they should start immediately assessing the impact of the tax on their operations.” The implementation of VAT was one of a number of reforms announced by Bahraini authorities, which also includes changes to its pension system and a new subsidy program. Bahrain announced a fiscal overhaul meant to balance its budget by 2022.

DUBAI

Tourism strategy

Dubai has approved an ambitious tourism strategy to attract 21 to 23 million tourists by 2022 and 25 million visitors by 2025. This is part of a strategy to strengthen Dubai’s position as a favoured destination and the most visited city in the world. The strategy was approved during a meeting of the Dubai Executive Council (DEC), chaired by Shaikh Hamdan Bin Mohammad Bin Rashid Al Maktoum, Dubai Crown Prince and Chairman of DEC. The strategy focuses on ensuring that Dubai is not impacted by fundamental changes in the future, and to be a leader when it comes to changes in the tourism sector. It also will seek to boost growth in major tourist exporting markets and diversifying sources from markets with high potential. Shaikh Hamdan said that plans and strategies to develop the tourism sector entail Dubai’s limitless ambition to bolster the emirate’s global position in the tourism field.

DUBAI/ABU DHABI

New rivièra between the two emirates

Work on AlJurf, a fully integrated second-home destination along Sahel Al Emarat, will start in 2019. A 370-hectare project boasting 3.4km of azure beachfront will be realised. Once complete, the destination will comprise three distinct districts -AlJurf Gardens, Jiwar Al Qasr and Marsa AlJurf- each with its own defining architectural characteristics and a range of facilities and amenities. The destination will feature two marinas, private berths, a town centre, hotels, retail, a wellness resort and clinic component, serviced residences and villas. AlJurf will also provide residents with access to public and private beaches, beach clubs and restaurants, community centers, parks, mosques, clinics and a private school.

EGYPT

Export of engineering products

Engineering products include a wide array of goods from home appliances such as refrigerators, ovens and heaters to cars, heavy machinery and even tractors, with some 21 sub-sectors being involved in the engineering industries. Egypt sells $2.7 billion worth of engineering products abroad annually. Finished goods represent around half of Egypt’s total exports. Fertilisers, textiles, ready-made garments, home appliances and wires and cables top the list of finished goods. Other exports include crude oil and oil products, raw materials such as crops, and semi-finished goods as iron and piping. The Export Council has set out to change these figures and to set up new companies to export and increase the exporter base. It is doing this in addition to traditional services such as organizing trade missions and taking part in exhibitions abroad. The Development Strategy (IDS) for 2016-2020 targets increasing the annual industrial growth rate to 8%. It also wants to increase the contribution of industrial production to GDP from 18 to 21%.

IRAQ

oil export from south Iraq booming

Oil exports from southern Iraq are heading for a record high, two industry sources said, adding to signs that OPEC’s second-largest producer is following through on a deal to raise supply. Southern Iraqi exports in the first 19 days of September averaged 3.6 million barrels per day, according to ship-tracking data compiled by an industry source, up 20,000 bpd from August’s 3.58 million bpd — the existing monthly record. The increase follows June’s pact among OPEC and allied producers to boost supply after they had curbed output since 2017 to remove a glut. Iraq in August provided OPEC’s second-largest increase as shipments drop from Iran, which is facing renewed US sanctions. A second industry source who tracks shipments also said exports had averaged 3.6 million bpd, reflecting smooth operations at export terminals and no sign that unrest in Basra, Iraq’s second city, was disrupting flows.

JORDAN

Jordan attractive for foreign investors

Companies like Expedia, Microsoft and Cisco have set up bases or invested in Jordan's capital Amman. Minister Shehadeh : "We're active and we're seeing lots of people being interested in Jordan. Secondly, tourism numbers are growing and I hear that tourism numbers are up 15% versus last year." Jordan has created development zones in different parts of the country with each area tackling different sectors, such as technology or logistics. The zones are designed to attract both local and foreign investments. Jordan's Investment Commission has tried to attract businesses by offering low tax rates, including a 5 percent rate of income tax on income generated from all economic and manufacturing activities undertaken in such zones.

KUWAIT

Smart city development

South Saad Al Abdullah city in Kuwait is billed as the Middle East’s first development to be both green and ‘smart’. Construction work on the site, which will cover 64 square-kilometres and cost an estimated US$4 billion, is expected to start late next year. The smart city is part of the country’s 30-year vision to transform itself into a hub for trade, finance and tourism, cutting its dependency on oil revenues. The project is being developed in partnership with South Korea and once finished, it will home around 400,000 people. Whilst South Saad Al Abdullah is still a few years off, smart technologies are already being built into other new housing developments like South Al-Mutlaa, close to the capital. The foundations are just being laid for what is Kuwait's largest housing project so far - with more than 28,000 homes being created. Kuwait's oldest souk is also being earmarked for the ‘smart’ treatment. Kuwait is one of many countries in the Middle East with ambitious plans to develop connected, competitive and convenient cities - contributing to the global smart cities market which it’s estimated will be worth $2.6 trillion by 2025.

LEBANON

Beirut electricity project

Electricité du Liban (EDL) has launched the tender to implement the second phase of the Beirut River Solar Snake (BRSS) project, which is expected to generate seven megawatts (MW) of electricity. The BRSS aims to build a solar energy farm on top of the Beirut River by covering it with photovoltaic panels. The project was designed to be built over ten phases, each expected to produce one MW. “The EDL got encouraged by the project and went ahead to build seven megawatts,” said Pierre Khoury, Director of the Lebanese Center for Energy Conservation. The second phase will see the installation of solar panels across 2,100 meters over the river's bed. EDL commissioned the first phase of the BRSS in 2015. Twenty-five international and local companies bid on the project. The $3.4 million contract was awarded to a joint venture between local firms Asaco and Phoenix. The first phase produces one MW. “We expect that the new tender will attract at least 50 to 60 interested companies,” Khoury said. Panels will be linked to the national power grid run by the EDL. Once complete, the BRSS will provide 10,000 households with electricity. Companies that wish to bid on the project are requested to visit EDL offices to pick up the tender documents. Bids must be submitted by December 21.

MOROCCO

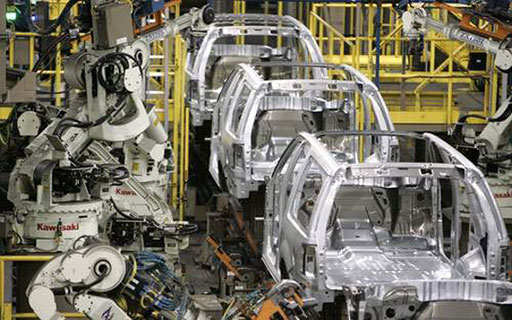

Morocco biggest African car producer

Morocco topped the podium of the biggest car producers in the African continent, outpacing South Africa. In 2017, Morocco’s two leading car factories in Tangier and Kenitra achieved a joint output of 376,000 cars, worth 70 billion dirhams. Between 2014 and 2017, total jobs created in the automotive sector in Morocco rose to 83,845. Last month, media reports said talks are ongoing between Morocco and the German car giant Volkswagen to set up a plant. Morocco raised its automotive industry target to 1 million vehicles by 2025 in light of the positive results shown by the sector, which is a valuable source of foreign currency for the country and which could generate 200 billion dirhams. Cars dominated Morocco’s exports in the first six months of 2018 with 35.973 billion Dirhams, as the country continues to attract automotive investments.

OMAN

Oman diversifies economy

Oman's economy is witnessing a structural transformation, with increased diversification leading to accelerated non-oil economic activities and reduced dependence on the hydrocarbon sector over the last few years. All three non-oil hydrocarbon groups (industry, services, and agriculture and fishing) witnessed growth in 2017. The agriculture and fishing sector is gaining focus due to huge scope, especially in fishing, as Oman is endowed with a long marine belt. The services sector continued on the upward trajectory and grew by 4.6% in nominal terms in 2017 and accounted for a 51.6% share in the overall GDP (Gross Domestic Product). The overall employment in the public sector recorded a growth of 1.8% in 2016, marginally higher as compared with 1.6% in 2015 but much lower compared with the average 7.8% during 2013 and 2014.

QATAR

Qatar expands economic zones to encourage SME’s

Qatar announced a major expansion of the economic zones for small and medium enterprises (SME’s) by developing an additional area of 825,000 square meter and providing the necessary infrastructure and basic services for industrial projects. The expansion would be completed in the first quarter (Q1) of 2019. With this, the total area of economic zones will exceed 11 million square meters. “Our goal is to increase the private sector output as a percentage of the national GDP. Your enhanced activities will bring better prosperity for our country,” minister al-Sada says. Al-Sada also launched an ‘industrial database’, an interactive electronic platform, which will have strategic importance in industrial planning.

SAUDI ARABIA

Improved economic outlook

The latest data released by the Saudi Arabian Monetary Authority (SAMA) points to an improving economic outlook. The data showed that credit to the private sector climbed for the fourth consecutive month in July while consumers also spent more, with point of sale transactions up by about a quarter on a year earlier. Cash withdrawls from ATM machines also rose more than 12 percent on a year earlier. The rebounding oil price has improved economic sentiment in the Kingdom and boosted expectations for economic growth. Last month the International Monetary Fund (IMF) said it expected real GDP-growth to increase to 1.9% in 2018, with non-oil growth strengthening to 2.3%. The IMF was broadly upbeat on the Saudi banking sector with credit and deposit growth although weak, expected to strengthen due to higher spending and non-oil growth. Bank profitability was also expected to increase as interest margins widen and banks remain well capitalized.

Tunisia

Public-private partnerships (PPS)

Tunisia will offer public-private partnership projects for the energy, transport and other sectors worth 13 billion dinars ($4.7 billion), to revive the economy and create jobs, the investment minister told Reuters. The partnerships include a deep water port at Ennfidha city and subway in the eastern city of Sfax as well as water, environment, logistic and technology projects. “We will present soon at an international conference major projects aimed at re-attracting new investments that will contribute to the creation of employment opportunities, raise Tunisia’s foreign currency revenues and revive growth”, investment minister Zied Ladhari said. “Today investors should know that Tunisia is a competitive destination with many privileges. We aim to attract investors from Europe, America and the Gulf,” he added.

Tunisians drink Belgian milk

Semi-fat milk imported from Belgium is available in large areas in Tunisia since the beginning of October. A first batch of 3 million liters has been delivered and will be followed by a second batch of 7 million liters. In the state of Tataouine, milk will be delivered by French and Spanish companies.