6th edition 2013, October-December

INNOVATION: A BUZZ WORD... OF IMPORTANCE

Three Success stories from the Arab World

In case the proliferation of lists and rankings that aim to identify the 100 most innovative states, regions, corporations and institutions has not yet rang a bell: being labeled an innovator is a much-sought after prize in today’s business world. And rightly so. Innovation is what helps companies stay ahead of their competitors, and, perhaps more importantly, one of the most important tools we have at our disposal for attaining a certain quality of life amid the myriad of challenges we are confronted with in a day and age which is characterized by globalization, technological revolutions, migration, and ecological problems that require our urgent attention.

As was underscored in a previous edition of the ABLCC newsletter by Mr. Jean-Claude Marcourt, Minister of Foreign Trade and New Technologies of the Walloon Region, innovation is born from synergies, from sharing expertise and collaborating on a global level. In two words, from transcending borders. We agree, and went looking for inspiring examples of strong innovation and entrepreneurship efforts on the other side of the Mediterranean. The need for coming up with a new type of development strategy to help countries grapple with the challenges that confront them – not in the least soaring unemployment rates – has all but fallen on deaf ears in the Arab world.

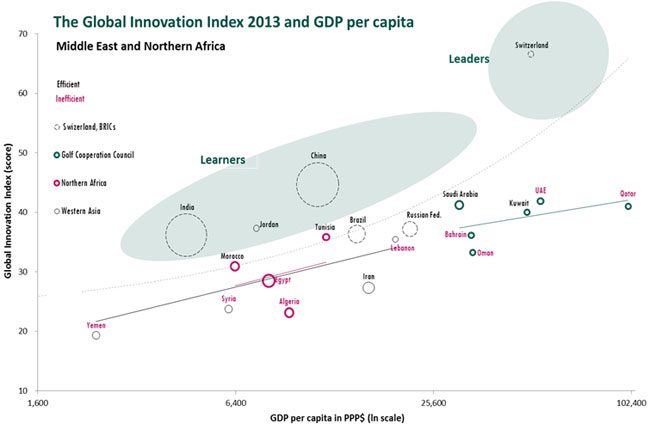

Indeed, as is mentioned on the Global Innovation Index 2013 Blog (http://www.globalinnovationindex.org/content.aspx?page=blog ), efforts to attract high-quality education institutions and foster the attractiveness of the region for innovative talents clearly remain a priority in the GCC region, and the Arab world as a whole. This was also noted by researchers of the World Banks’ Center for Mediterranean Integration (CMI), who identified three success stories of local innovation projects in the Arab world in their report “Local Innovation Dynamics: Examples and Lessons from the Arab World” (Jean-Eric Aubert, Tamer Taha, and Anuja Utz, The Global Innovation Index 2013, The Local Dynamics of Innovation, ‘Local Innovation Dynamics: Examples and Lessons from the Arab World’, Cornell University, INSEAD, and WIPO, Geneva, Ithaca, and Fontainebleau. http://www.globalinnovationindex.org/content.aspx?page=gii-full-report-2013#pdfopener ): The Elgazala Technopark in Tunisia, which specializes in information and communication technologies (ICTs), Haliopolis in Morocco’s Agadir, an agrifood cluster, and the city of Dubai, which has particularly witnessed dynamism in service innovation.

According to the CMI, the recipe for success underlying all three cases consists in a combination of efficient government action, dynamic interactions among local actors (meaning collaboration between industry and the on-site academic and research institutions), internationalization of the sites, a focus on (potential) competitive advantages of the sites, and a sustained effort for attaining diversification and renewed sources of growth. The CMI furthermore underscores the importance for governments to be visionary catalysts rather than ‘hands-on’ investors (a process which can be usefully stimulated by an exchange of good practices, study tours, and so on within the region and with other parts of the world), to be international integrators, by inserting actors into the global economy by all means possible, including regional integration processes, and to be clever strategists, who begin with fine-tuned and focused rather than grandiose projects. Join us in discovering inspiring examples of local innovation dynamics in the Arab world.

Elgazala Technopark: putting Tunisia’s ICT sector on the map

The World Bank researchers count about one hundred firms that have set up camp in the park, among them thirteen multinationals, including Microsoft, Huawei, Alcatel-Lucent, and Stonesoft, a steep increase from the twenty-five companies it harbored in 2002

Launched in 1999 as part of Tunisia’s national strategy to develop the ICT sector, Elgazala Technopark park is home to a business incubator, a research centre dedicated to the ICT industry, various telecommunication schools, including two doctoral schools, and several research divisions dealing with ICT-related disciplines: telecommunications systems, network engineering, mobile networks, information systems, and business communications. Several national agencies—such as the National Electronic Certification Agency and the National Frequency Agency— also set up camp in the technopark to cater to the needs of ICT companies. The park’s self-set goals, which include establishing Tunisia as a player to reckon with in the ICT sector across the Mediterranean basin, promoting the export of services and products based on the Tunisian grey matter, and developing and spreading the use of ICT in the various economic sectors in Tunisia, seem to come within reach a little more every day. According to the CMI, the number of employees working in the technopark has increased from five hundred in 2002 to about two thousand currently, 70 per cent of whom have a Master-level degree in engineering, or an equivalent degree. Moreover, the World Bank researchers count about one hundred firms that have set up camp in the park, among them thirteen multinationals, including Microsoft, Huawei, Alcatel-Lucent, and Stonesoft, a steep increase from the twenty-five companies it harbored in 2002. And, the report adds, 67 per cent of these personnel are working in a private sector entity.

The CMI identifies the Elgazala environment as highly conducive to technology transfer, a characteristic that resulted in the set up of numerous intra-company partnerships and joint participation in calls for proposals and consultations. Moreover, it notes the existence of an influential spillover effect on the quality of the output produced by the companies in the technopark, with 75 per cent of production taking place in the technopark in areas such as software and information technology solutions and services being destined for export. The success didn’t go by unnoticed, as the Tunisian government decided in 2008 to erect two new technology parks in the suburbs of Tunis, and has plans to replicate the Elgazala model for other sectors. In this framework, the report refers to the textile and clothing sector at the Monastir cluster, renewable energy, water, and biotechnology at Borj Cedria Technopol, and agrofood industries at the Bizerta technology park located in the north of the country.

Agadir’s Haliopolis: innovation as an engine for competitiveness in the fisheries sector

Haliopolis aims to enhance forward linkages in the seafood-processing industries, such as in packaging, conditioning and the provision of logistics services. Although the project is still in its early stages, all lots of the first phase were sold by the end of September 2012 for twenty-one projects covering different segments of transformational processing, such as deep-freezing, preserving, producing flour and fish oil, and processing algae

In Morocco, where industrial development strategies and infrastructure improvements have been sitting high on the agenda over the past decades, it is to the city of Agadir, capital of the Souss-Massa-Draâ region and home to a well-developed agro-food sector, that the CMI draws attention. According to the report, the city has been chosen to host the country’s first fishing and processing seafood cluster because of its high growth potential in this field, in addition to its location (it is near to Agadir harbor and the International Airport, and connected to northern Morocco by an expanding highway network) and know-how in seafood processing.

At the heart of a strategy dedicated to boosting the contributions of the fisheries sector to the Moroccan national economy, we find the Haliopolis Park, which was established in 2009 to cluster all actors in the value chain of the seafood processing, and to integrate various actors as sources of innovation. According to the CMI, the park is registered as a company with stockholders from the private sector and aims to enhance forward linkages in the seafood-processing industries, such as in packaging, conditioning and the provision of logistics services. Although the project is still in its early stages, all lots of the first phase were sold by the end of September 2012 for twenty-one projects covering different segments of transformational processing, such as deep-freezing, preserving, producing flour and fish oil, and processing algae. Using innovation as an engine for competitiveness, Haliopolis offers support to R&D projects for companies within the cluster to improve their research skills and to create partnerships with research institutions. It is argued that the park’s successful performance – the report directly links its establishment to Morocco’s current status as one of the largest producers and exporters of seafood in Africa – has been in no small part the result of the promotion of technological innovation, the increased effectiveness of support measures provided to companies seeking new markets, and the development of logistics to optimize costs and improve connectivity of Morocco with different destinations, especially the African market. The conclusion is that the Agadir success story is largely the consequence of an excellent synergy between actions taken by dynamic industrial and agricultural communities on one hand, and efficient government policies on the other, combining adequate investments in infrastructure and appropriate support for innovation and export.

Dubai: (back) on track thanks to innovation

TECOM Business Parks comprises ten interconnected business parks arranged in five industry clusters: the ICT, Media, Education,Sciences, and Manufacturing and Logistics sectors. According to the report, some 4,500 businesses have taken part in these clusters and business parks, not only because of the state-of-the-art infrastructure available, but also as a result of generous incentives provided by the government

Also in Dubai, it was well understood that the establishment of a well-diversified economy through stimulating innovation is the way to go. The CMI argues that Vision 2010, which aimed to lead the Emirate on the path towards a knowledge-based economy, and the Dubai strategic Plan 2015, which strives for the attainment of social, economic and environmental sustainability, have significantly bumped up the GDP share of knowledge-based industries and services between 1995 and 2012 in tourism, financial services, manufacturing and transport, and storage and communication, which accounted for 4%, 11.3%, 14.2%, and 14% of GDP in 1995, 2000, 2011, and 2012, respectively.

And also in Dubai, companies aren’t ignorant of the beneficial effects of business parks. The CMI puts the spotlight on TECOM Investments, a member of Dubai Holding and a global company dedicated to the development of knowledge industries and business growth, which it does in part through TECOM Business Parks. It more particularly comprises ten interconnected business parks arranged in five industry clusters: the ICT, Media, Education,Sciences, and Manufacturing and Logistics sectors. According to the report, some 4,500 businesses have taken part in these clusters and business parks, not only because of the state-of-the-art infrastructure available, but also as a result of generous incentives provided by the government. It states that Dubai has also emerged as a dynamic financial hub for the region, hosting many banks and insurance, financial, and legal service firms. The government established the Dubai International Financial Center (DIFC), a free zone regulated by its own independent commercial and civil laws and under the United Arab Emirate constitution, which provides a competitive operating environment that offers many advantages, including the possibility of full foreign ownership, a 0% tax rate on income and profits (guaranteed for a period of 50 years from 2004), and no restrictions on the repatriation of income and profits. Regulations which, according to the CMI, have opened the door for financial institutions to start introducing financial innovations to the market, notably in Islamic finance. After the global financial crisis, real estate speculation and huge debts put a question mark behind the growth model espoused by the Emirate, it appears to the CMI that Dubai has recovered and is now continuing its trajectory on a modest growth path. Their recommendation for ramping up Dubai’s growth to levels formerly witnessed in the Emirate, and more? You guessed it: intensively exploring new areas in high-tech and R&D activities, and developing top-notch higher education programmes to educate a cadre of highly skilled people. The current day economic scenario is confronting many states and regions in the world with tough challenges, but there’s a powerful medicine that’s up for curing a lot of the troubles ailing the economy, and since times immemorial, its label reads “innovation”.